fundamental risk affects closed end funds in which of the following ways

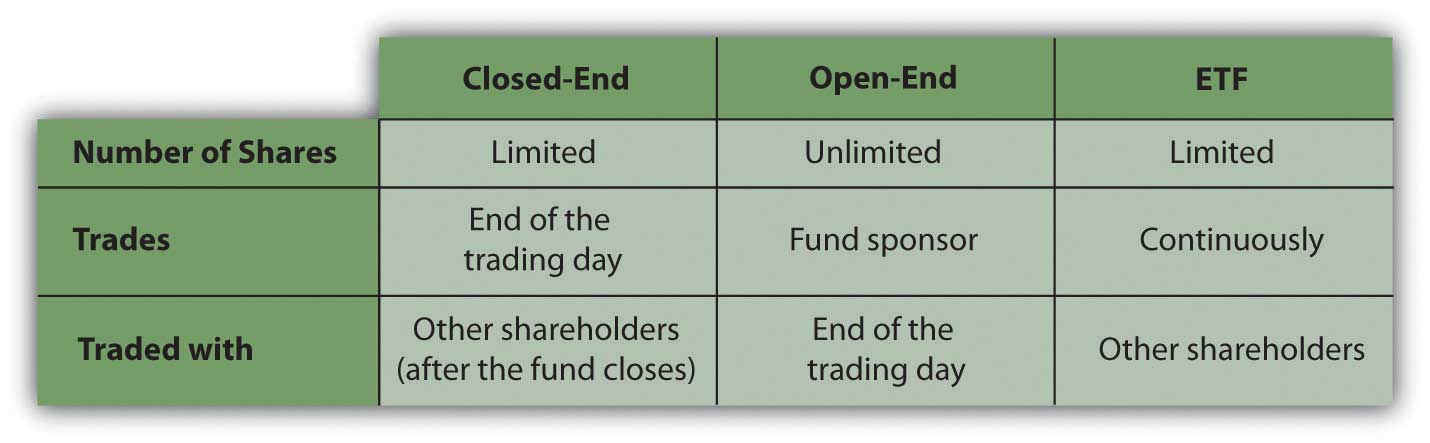

Closed-end funds are a type of investment company whose shares are traded in the open market like a stock or ETF. For those seeking to earn higher yields than available from mutual funds closed-end funds can be enticing due to their low-cost leverage.

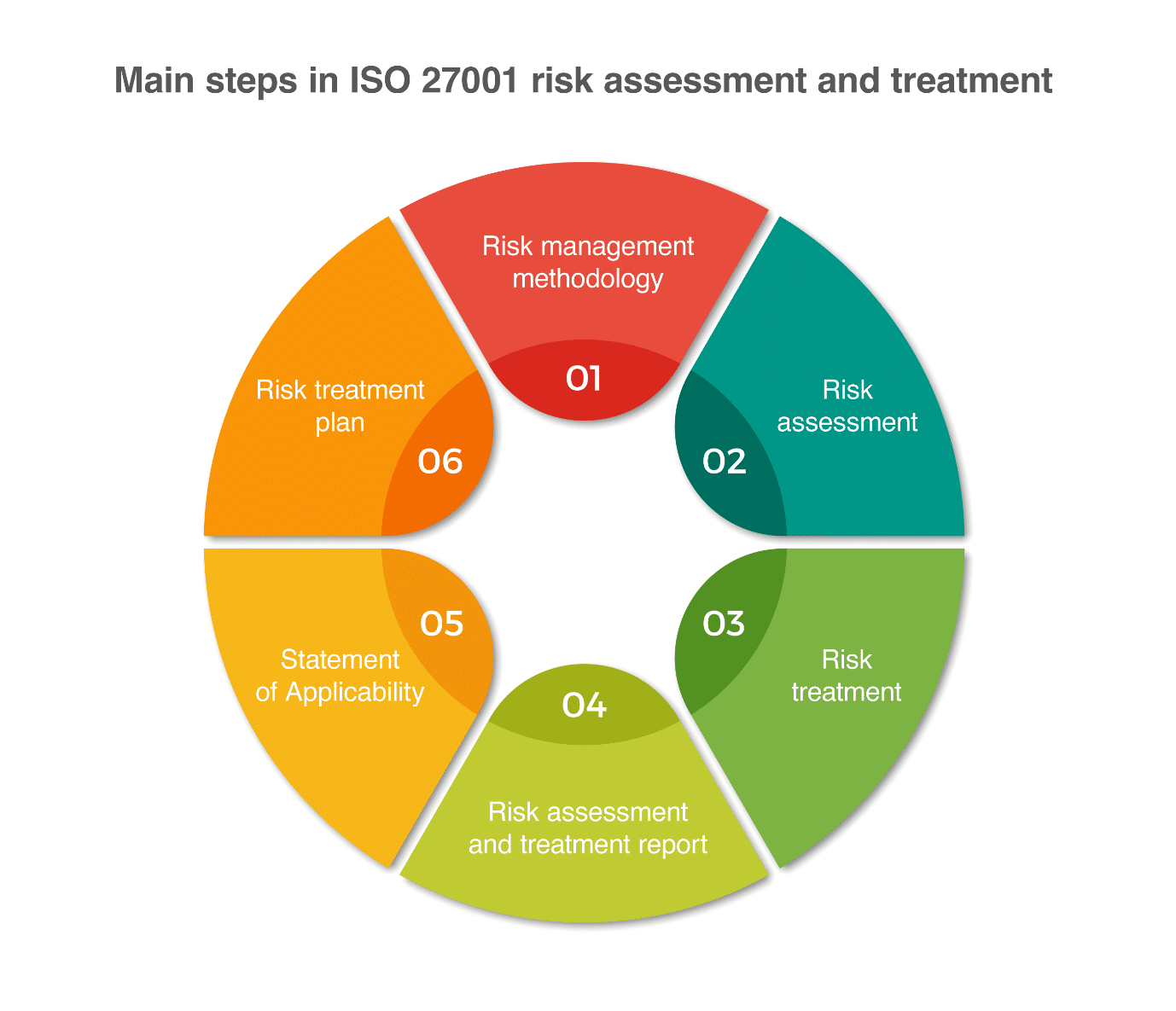

Iso 27001 Risk Assessment Risk Treatment The Complete Guide

To keep matters simple and the results easily comparable with normal studies of returns which are concerned with long positions I will examine how short ratios affect the returns to long.

. The Advantages and Risks of Closed-End Funds. Shares of closed-end funds frequently. A closed-end fund CEF is a type of mutual fund whose shares can be purchased and sold on a stock exchange.

There are also non-listed CEFs with continuous subscriptions and regular typically quarterly. Suppose that an open-end income fund is opened to investors and issues 10 million shares at 10 each raising 100 million for the fund which it. Closed-end funds are more likely than.

It is called closed-end because it has a fixed number of shares. Diversifying across closed-end funds does little to reduce th. Since market demand determines the price level for closed-end funds shares typically sell either at a premium or a discount to NAV.

Closed-end funds may trade at a discount or premium to their NAV and are subject to the market fluctuations of their underlying investments. Irradional noise traders earn high returns for bearing risk that they themselves create. Because closed-end fund shares typically trade on an exchange CEF shares fluctuate in price throughout the day.

A closed-end fund is a professionally managed investment company that pools investors capital during an IPO period and invests in stocks bonds or other. The term feature ensures NAV liquidity upon maturity. What is a Closed-End Fund.

Like other ETFs and mutual funds a closed-end fund is made up of a collection of securities and can provide. A closed-end fund is a fund that offers a set number of shares. The use of leverage allows a closed-end fund to raise additional capital which it can use to purchase more assets for its portfolio.

A closed-end fund legally known as a closed-end investment company is one of three basic types of investment companies The two other types of investment companies are open-end funds. Capital does not flow into or out of the funds when shareholders buy or sell. Study with Quizlet and memorize flashcards containing terms like The idea of mutual fund is based on the idea of pooled diversification Mutual funds typically offer more diversification.

Open-end fund shares on the other hand are generally priced once every. Example of a Closed-End Fund. The use of leverage by a closed-end fund.

Listed CEFs can offer intra-day liquidity.

A Survey Of Behavioral Finance Ppt Download

Pricing Factors Fixed Income Raymond James

Investing In Mutual Funds Commodities Real Estate And Collectibles

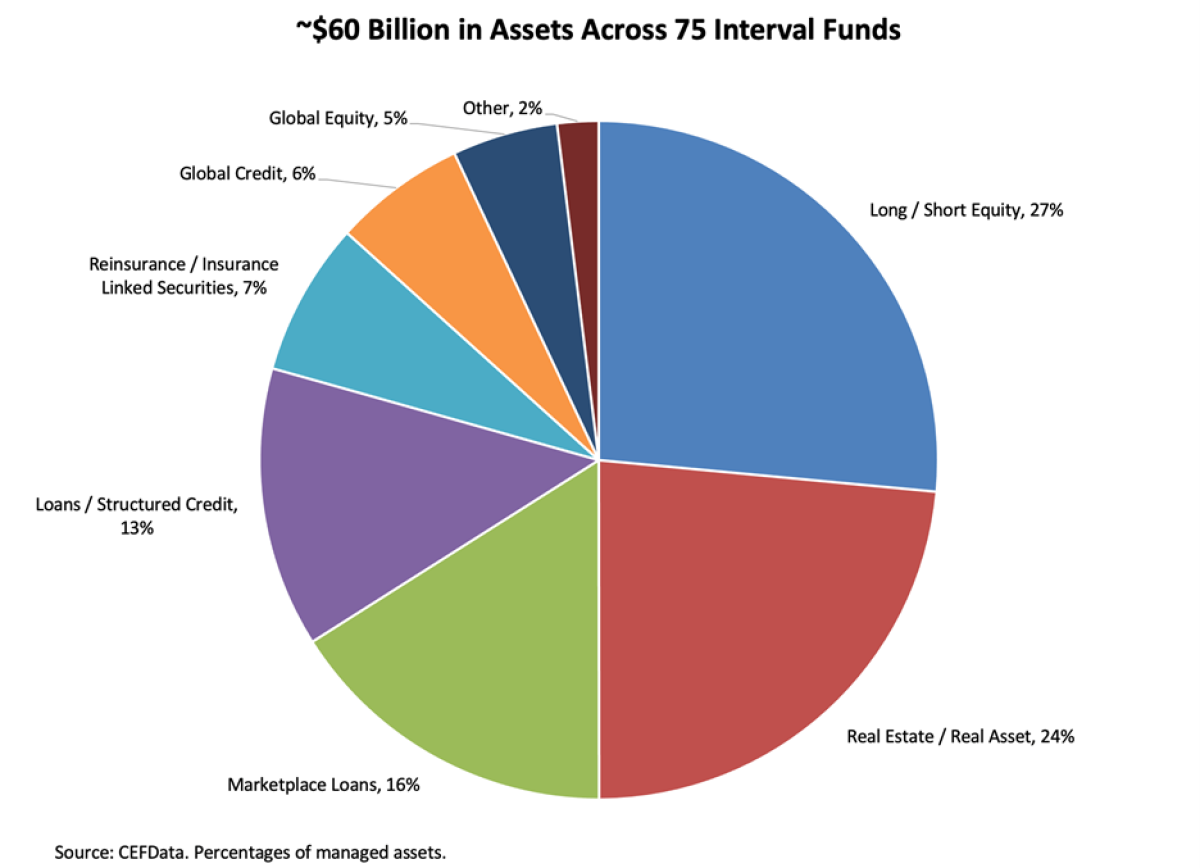

Interval Funds Are A Fast Growing Alternative Investment Vehicle Portfolio For The Future Caia

What Are Spacs And Should You Invest In Them Money For The Rest Of Us

Open Ended And Evergreen Funds In Venture Capital Toptal

Federal Register Enhanced Disclosures By Certain Investment Advisers And Investment Companies About Environmental Social And Governance Investment Practices

A Guide To Investing In Closed End Funds Cefs

Closed End Funds Investment Guide Blackrock

Coronavirus Business Impact Evolving Perspective Mckinsey

Top 17 Hedge Fund Industry Trends For 2022 Coresignal

What Is The Difference Between Closed And Open Ended Funds Quora

Hedge Funds 101 What Are They And How Do They Work Pitchbook

4 Questions To Ask Yourself Before Buying Cryptocurrency Nextadvisor With Time

How The Gamestop Roller Coaster Could End

:max_bytes(150000):strip_icc()/mfhistory.asp_final-a021d511916f4e88806ddb91b4c08e6c.png)

A Brief History Of The Mutual Fund