uber eats tax calculator nz

But now as restaurants try to recover and reopen in a limited capacity more sustained measures. Order food online or in the Uber Eats app and support local restaurants.

Making The Most Of Your Time On The Road Uber Blog

There is a lot of confusion around GST registration for Uber drivers.

. I cant easily calculate my usage as I check my Uber apps daily but only work casually when I feel like it. As an independent provider of transportation services you will be responsible for your own taxes when driving for rideshare companies. Get contactless delivery for restaurant takeaway groceries and more.

I recieved summary from Uber I am still confusing with about fare breakdown 8000 and potential deduction uber service fee. Uber Eats does not subtract taxes from your earnings so you will need to account for that when you file your tax return. Full-time work is more than 30 hours a week on average over a tax year.

It is important that you keep all. Income tax and GST. Log in to your existing account or tap register to create a new account.

Your 1099-K is an official IRS tax document that includes a breakdown of your annual on-trip gross earnings. Average income for Uber drivers will vary on the circumstances of each driver but an average income of 25 to 35 per hour after Uber takes its cut is about average. All you need is the following information.

Unlike rides with Uber drivers who earn with Uber Eats are only obligated to register collect and remit sales tax from the moment they reach 30000 of revenue over the past 4 quarters. I am doing uber eats and need to lodge my tax. Answer 1 of 6.

The average number of hours you drive per week. Phone is monthly 110 total. According to the IRD you must register for GST if you carry out a taxable activity and your turnover was 60000 or more.

You use the car to transport the passenger for a fare. You will need to register for a GST number in New. According to financial accounts filed with the New Zealand Companies office Uber declared gross revenues of 1061018 in New Zealand in 2014 but paid just 9397 in income.

Use this calculator to work out your basic yearly tax for any year from 2011 to 2021. If you work full-time and earn less than the minimum over a tax year well use the minimum amount to calculate your. Fees paid to you when you provide personal services are taxable income.

UberPool riders in California pay the price shown before the trip. Work out tax on your yearly income. She said she also deducts A50 per week so she can pay the money directly to the Australian Taxation.

So you pay 153 of this so called self employment tax. Well send you a 1099-K if. Uber Eats is growing in popularity in New Zealand and Australia.

Using our Uber driver tax calculator is easy. In 2021 Uber Eats will introduce new product features designed to simplify and improve the way eaters delivery people and merchants use the Uber App. A passenger uses a third-party digital platform such as a website or an app to request a ride for example Uber Zoomy or Ola.

Your average number of rides. I would keep all of your expenses and mileage in a spreadsheet. One thing to understand is that Uber Eats does their tax documents like 1099 forms kind of funny.

For purposes of this tax calculator just use the total money you actually received from Uber for the year. Download the Uber Driver app from Google Play or the Apple App Store. Then you also pay income tax just like an.

Uzochukwu From your question I am assuming you are a new driver to Uber. Find the best restaurants that deliver. On other ride options in California riders will see an estimate that includes all applicable charges but the final price is.

If youre providing your time. It will not include any tax credits you may be entitled to for example. Your employer pays the other half.

As a self employed person you pay both halves. You may also have to pay goods and services tax GST. Uber Eats has dropped its commission fees cap 5 per cent to 30 per cent.

Using Uber as an. Do I just divide by 4 to get weekly. They report different income than what was deposited in your bank account and the uber tax summary can be confusing.

Making The Most Of Your Time On The Road Uber Blog

Making The Most Of Your Time On The Road Uber Blog

![]()

Uber Eats Food Delivery Uk On The App Store

Making The Most Of Your Time On The Road Uber Blog

Making The Most Of Your Time On The Road Uber Blog

Is Uber Eats Too Expensive How Much Are They Actually Taxing Me On Top Of The Food Order Price Quora

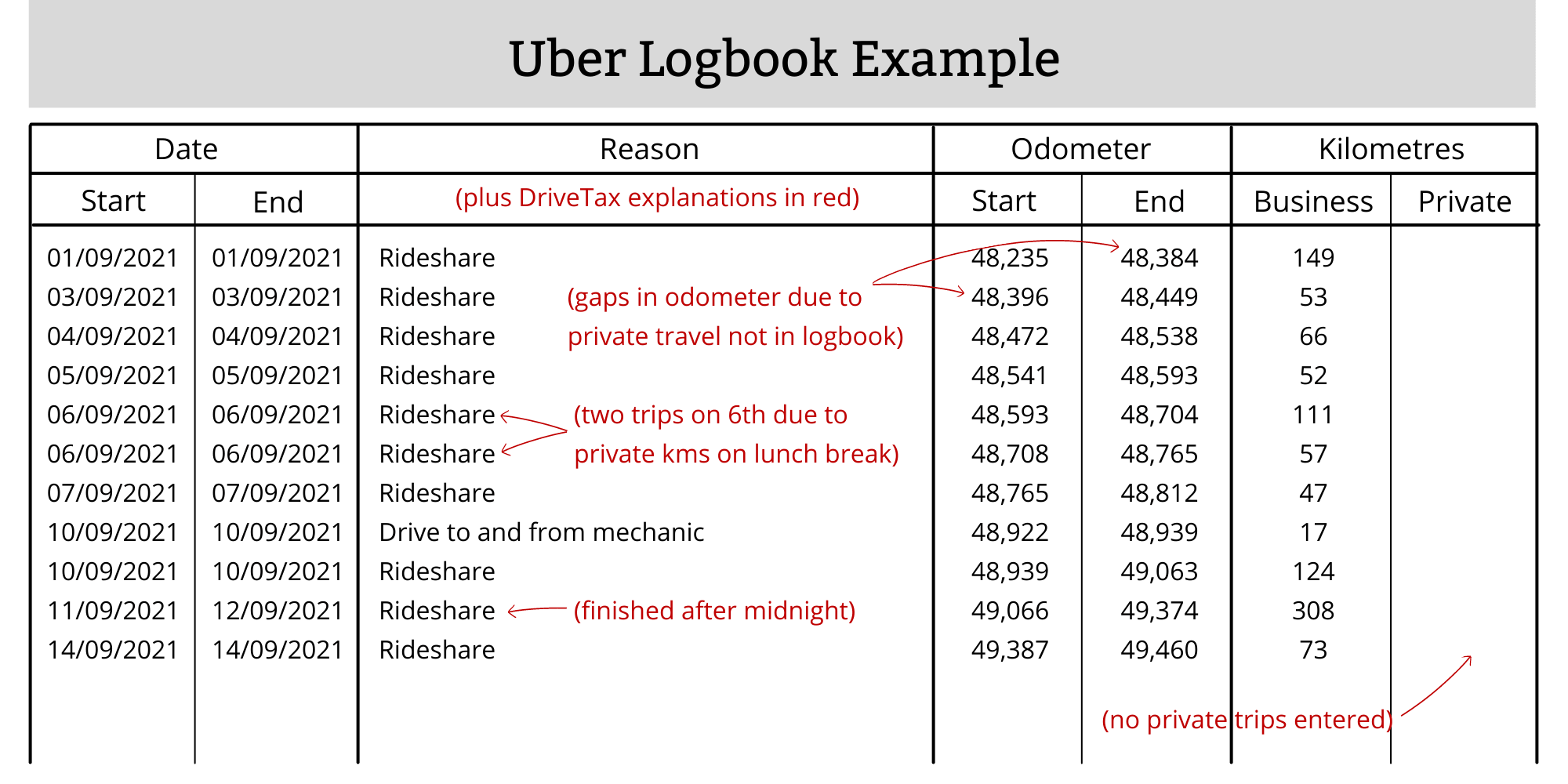

How To Keep A Logbook For Uber Rideshare Food Delivery Drivers

Making The Most Of Your Time On The Road Uber Blog

Uber Eats Food Delivery On The App Store

Making The Most Of Your Time On The Road Uber Blog

Making The Most Of Your Time On The Road Uber Blog

Making The Most Of Your Time On The Road Uber Blog

Is Uber Eats Too Expensive How Much Are They Actually Taxing Me On Top Of The Food Order Price Quora